Bank Feeds

Connect Acumatica to more than 14,000 financial institutions for streamlined bank reconciliation and expense management.

Key business benefits

Related Resources

Save Time and Improve Data Accuracy with Automated Bank Feeds

Connect Acumatica to more than 14,000 financial institutions. Schedule bank transaction imports to Acumatica. Link savings, checking, and corporate credit card accounts to cash and expense accounts inside the ERP solution. Eliminate manual reconciliation and matching with auto-match capabilities and default settings.

SCHEDULED IMPORTS

Schedule bank feed imports for savings, checking, corporate credit cards, investments, loans, or other financial accounts. Connect to multiple banks with varying import schedules per account.

SMART MATCHING

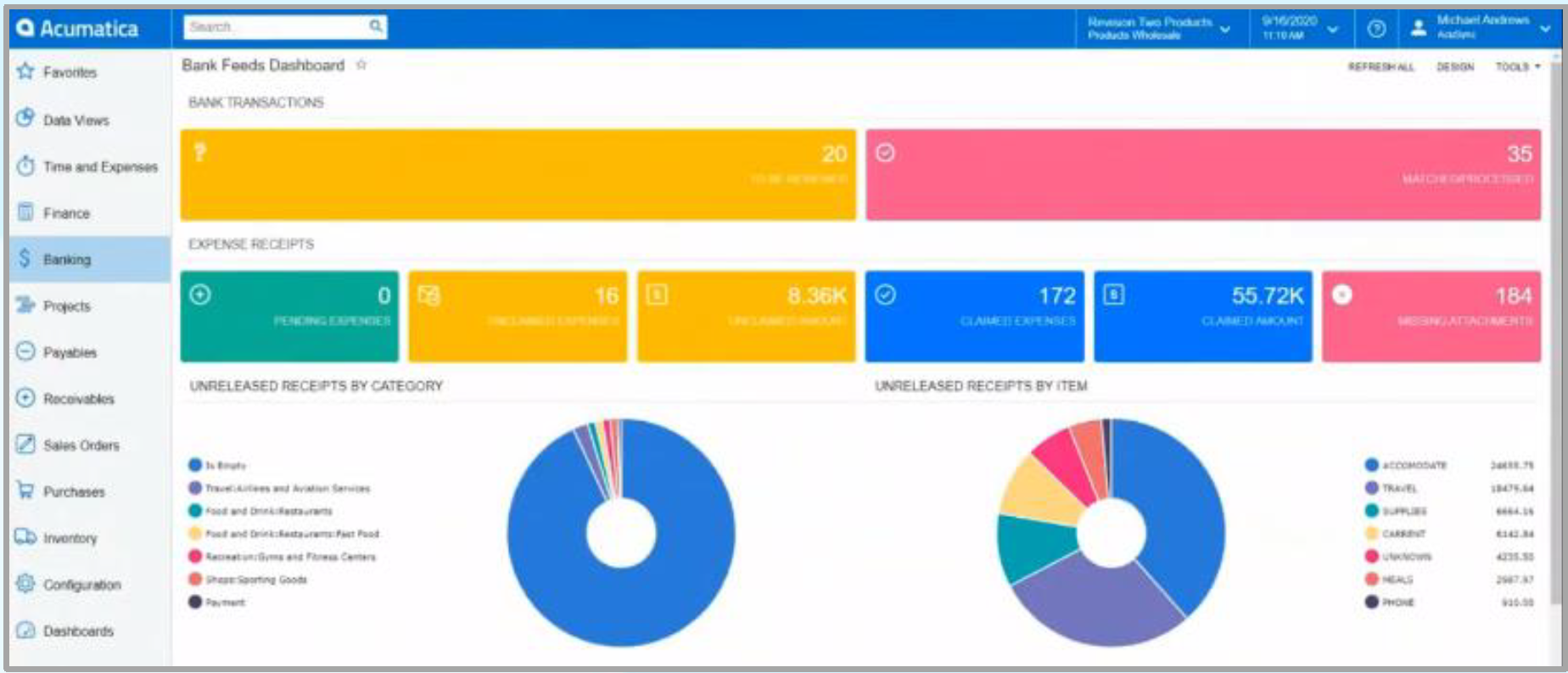

Using customisable business rules and near real-time activity downloads, Bank Feeds

provides automated smart matching to existing transactions. Dashboards and reports

highlight transactions that require attention.

SECURE ACCESS

Bank Feeds utilizes Plaid and MX, industry-leading connection platforms deployed by

thousands of financial institutions and businesses, to securely aggregate and format

data. Connections and data transfers use Multi-Factor Authentication (MFA), Advanced

Encryption Standard (AES 256), and Transport Layer Security (TLS) for information

exchanges. Acumatica stores secure tokens for information transfers and does not

store sensitive banking information.

*Bank Feeds supports popular banks. Bank Imports are used for other institutions.

Acumatica’s unlimited user license structure will enable us to scale, and once we have the AP AI bank feed, it will help with cash reconciliation, electronic reconciliation, and bank fees. We have more timely information, and much more opportunity.

– Andrea Deakove, Project Lead, REMCAN Projects

Bank Integration

Bank Feeds utilizes industry-leading aggregators Plaid and MX to retrieve and format transactions from more than 14,000 financial

institutions.

Secure Connections

Multi-Factor Authentication (MFA), Advanced Encryption Standard (AES 256), and Transport Layer Security (TLS) ensure safety and security for all information exchanges.

Transaction Matching

Default settings, artificial intelligence, and machine learning automatically match bank transactions with Acumatica transactions. Match one bank transaction to one or more payments, invoices, receipts, credit memos, and debt adjustments.

Manage by Exception

Unmatched transactions are conveniently displayed in dashboard views for review and manual matching or categorization in

Acumatica. Write-offs of AR balances and credits are supported.

Audit Logs

Bank feed updates are logged at the record and field level in Acumatica, providing traceability for all financial data transactions.

Flexibility

Advanced mapping and custom data provider connections provide flexibility to automate any business scenario virtually.